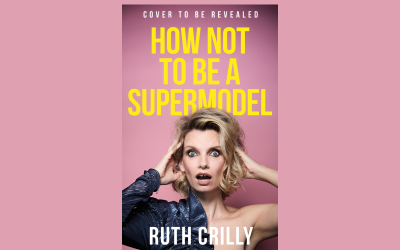

It's the moment you've all been waiting for*: my first ever book, How Not To Be A Supermodel, is available for pre-order! Here! An actual book that you will be able to hold in your hands. Or, if you prefer my dulcet tones, listen to with your ears. You've loved my...

Why I Love a Staycation (and Some Favourite Self-Catering Gems)

After a rather lengthy foray into Disney parks and Florida road trips, we're back on home turf for a bit of "UK staycation*" action. I've been meaning to share these little self-catering gems with you for a while: my favourite finds, the houses and cottages and cabins...

How To Do Disney World If You’re Not Into Disney

In case you've stumbled upon this post via a Google search, please be aware that this is a very specific article. It's a guide to visiting Disney World if you're not that into Disney. I myself am not that into Disney. And I worry about saying this, because some of the...

How To Book A Holiday That You’ll All Enjoy

I really thought I'd planned the dream holiday. One of those "once in a lifetime" sort of affairs that the whole family would enjoy and treasure forever. A holiday we'd all love so very much we'd still talk about it years down the line, when the kids were teenagers -...

March Favourites

A quick post today because I am writing this on Easter Sunday, when strictly speaking I should be trying to talk my kids down from their rampant sugar-high. One of them is currently gyrating to the Wonka soundtrack, the other has filled up a water pistol and is...

What’s In My Makeup Bag? Spring 2024

Fancy a delve into my springtime makeup bag? Why does that sound so dirty? Is it just me? This is what happens when I spend days editing content all by myself without any sensible adult conversation... You should know that I very rarely change my makeup looks...

How To Grow Out A Bob

I'm growing out my shorter hair so that it will sit just above the shoulder and am told by my hair stylist that what I am officially doing is going from a "bob" to a "lob". For the past two years I've swung between these two comically-named hair lengths and have had...

Camo Is A Neutral (And Also Makes Me Manspread)

In a surprise turn of events, I've become rather attached to a pair of camo-print cargo trousers. In fact I've barely taken them off for an entire week, wearing them with everything from cashmere jumpers to pretty blouses and cotton t-shirts. It's a surprise turn of...

February Favourites

Five February Favourites, including the very timely rediscovery of an absolute skincare marvel and an incredible book of short stories. But let's start with the boots I've fallen for. Oh, the boots. If I told you that I'd been searching high and low for the perfect...

Sézane Try-On: Dress Me Like A French Girl

Well, I was seduced again. I went on the Sézane website, saw that absolutely everything on there would almost definitely make me look like a twenty year-old Parisian sex-kitten from the seventies and then ordered a load of stuff. It arrived, I unwrapped my haul from...

3 Best Beauty Buys: February 2024

My three best beauty buys this month - picked out from the quagmire of new launches for their excellent performance, high quality and price-tags that won't cause immediate heart palpitations. Ad info: no paid or sponsored content. Contains press samples and affiliate...

How Not To Be Sexy In Bed

Do you want to know what I wear to bed these days? I'm going to tell you anyway, so you may as well say yes. Don't worry, it's nothing that's going to make you blush or feel awkward about life if we suddenly bump into each other outside Tottenham Court Road station -...

January Favourites: I’m A Stampfluencer Now

January "favourites" and what an eclectic mix we have going on here! Family photo albums, rubber stamps and a stand-up show that will have you chortling away and wishing for more. As per monthly favourites tradition, there's a video to accompany this post - it's right...

What’s In My Mystery Makeup Bag?

I took a little makeup bag with me on an overnight trip a couple of months ago and then when I got home again from my travels I forgot to unpack it. I only happened upon it by total fluke, the other week, when I went searching for one of those sticky clothes rollers...

Six Week Invisalign Update: Permanent Low-Key Crossness

I'm six weeks into my Invisalign treatment (read this if you need to catch up on why I'm doing it) and despite the experience being relatively drama-free, so far, I've realised this week that never in my entire life have I felt such a permanent sense of...